Students today are being churned out of college more ignorant than ever before, at least when it comes to real-world stuff like financial literacy. A study in the Journal of Consumer Marketing reveals that the majority of college students now don't even know the interest rates on their credit cards.

That's because behind the veneer of high tech gadgets, the whole education system is a relic from simpler times. Your grandparents could go to college for the few hundred dollars they earned in their spare time and come out set for life, but students today are taking out hundreds of thousands of dollars in crippling life-long loans to learn a dumbed down version of the exact same ancient stuff.

Now more than ever, financial literacy is vital for living a happy and fulfilling life. Here are some basics about money that you won't learn in your college curriculum.

Times have changed

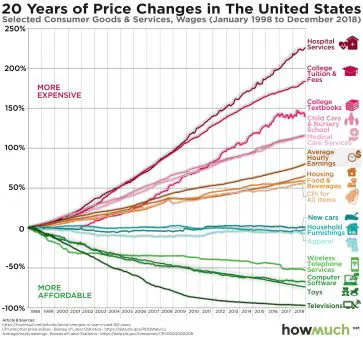

Don't listen to the boomers: we're living in entirely different worlds. The cost of college, healthcare, and childcare have drastically increased above wages. This means that you'll need to be even more prepared than your parents if you want to have the luxuries that were handed to them.

Don't listen to the boomers: we're living in entirely different worlds. The cost of college, healthcare, and childcare have drastically increased above wages. This means that you'll need to be even more prepared than your parents if you want to have the luxuries that were handed to them.

And it's not just the numbers that have changed -- the entire foundation of the U.S. economy has shifted in tune with the march of technology and globalization. It's unlikely that you'll land a comfortable job with benefits right out of college. You're likely going to slave away in the service industry and your employer won't give you benefits, tuition reimbursement, or any of the nice things boomers had. There is simply too much cheap labor and automation available.

In summary, don't expect the same things your parents had without putting in a hell of a lot more effort.

There are other streams of income besides a 9-to-5 job

Chances are you won't get a 9-to-5 job you'll comfortably work for 40 years and then sail off to Florida with a fat pension. Instead you're expected to be your own boss and plan your own future.

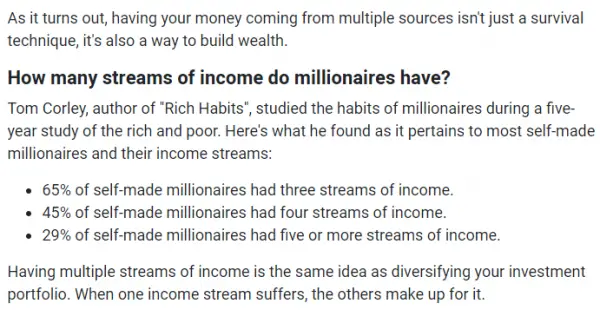

But there is some good news: this means you have quite the incentive to explore a universe of opportunities. It's often said that most millionaires have at least seven streams of income, and it's not difficult finding multiple streams of income in the internet age.

You could cultivate your talents and open up an online shop. You could do 3D printing on Fiverr. You could sell Klingon translation services to hipster companies. If you have an entertaining personality, or the ability to invent one, you could do streams or play video games on Twitch. And on and on.

People always have and always will want to trade their resources for the products and services of other people, and those products and services can be as stupid and ephemeral (Twitch donos, anyone?) as a hammer is solid. That's the fundamental truth about money that sets your imagination free.

College is no longer the golden ticket

For some people, college is worthwhile in the long-run. But you can get a head start and earn a lot more money while you're young by picking up a trade instead. After all, college isn't for everyone.

For example, if you're interested in computers and wanted to try your hand at programming, you don't need a college degree. There are a lot of affordable coding bootcamps that will teach you the essentials in just a few weeks. Additionally, there are a ton of free books and resources available online. If you absolutely need instruction, an associate's degree at a community college would suffice. Computer programmers can easily earn over $80,000 per year.

You can also make a lot of money if you want to learn a traditional trade, like construction and plumbing. Plumbers can easily make $25 per hour, and the job typically involves installing and maintaining pipes and appliances. Electricians can also make around $25 per hour. Construction managers who have been in the field for a long time can make up to $50 per hour.

https://twitter.com/jsolomonReports/status/1237396411777499137

Taxes

Taxes are complicated, and filing your federal tax returns for the first time can seem daunting. Those who don’t earn enough income aren’t required by law to file a federal tax return, but it's always a good idea to file because you might be eligible for a refundable credit.

If you have a simple return -- where you're not self-employed and have taxes withheld from your paycheck by your employer -- then you'll likely qualify for a free simple federal tax return if you made less than $65,000 in the year. Tax preparers like TurboTax and H&R Block offer free-file services.

Remember to file your taxes on time -- you typically get your W-2 form from your employer in January, and you have until April to file. That should be plenty of time to get everything sorted on time. And if you owe the IRS money, they'll charge you a late fee of 5% of your unpaid taxes for every month late.

Also keep in mind that you might qualify for deductions which increase your returns. If you're paying tuition for school or you're paying student loan interest, you'll likely qualify for a deduction. You may also qualify for deductions for medical or dental expenses.

Start saving early

It's not about how much you make. It's about how much you save. The earlier you start saving, the better of you'll be in the long run. This is because of the magic of compound interest. Here's a simple explanation of compound interest:

- You keep a principal (initial) amount of money in a savings account

- The first year, you'll earn interest on the principal amount

- The next year, you'll earn interest on the principal amount plus the interest earned in the years prior

In other words, you'll keep earning passive income through interest rates just by saving money.

You should also look into a 401(k) plan, which is a tax-advantaged retirement account offered by some employers. Workers can often contribute to their plan through automatic payroll withholding, and sometimes employers will match that amount.

Building credit history

It's important to build up a good credit history, because it will affect your ability to borrow money, get a job, and find a place to live.

A study showed that 36% of U.S. college students say they already have more than $1,000 in credit card debt, but credit card debt isn't a terrible thing as long as you're able to make payments or quickly pay off your purchases. If you make a lot of payments on time with credit, your credit score will go up. Your credit score shows that you're a reliable borrower. But if you don't make payments or default on your loans, you'll have a hard time borrowing money.

Your FICO credit score is the most commonly used score by lenders, and it considers your payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). You'll want to have a credit score of at least 700 or more.

A good rule of thumb when building or maintaining a good credit score is to only use 10% or less of your credit card's line of credit. For example, if your limit is $1,000, use only $100 of it every month and pay off the entire balance.

If you're trying to rebuild your credit history, you may only qualify for a secured card, which requires an upfront, refundable security deposit that equals your credit limit. If you don't repay what you owe the lender, they can take your deposit.

Here's a few simple tips to remember when building your credit history:

- Pay your bills on time. If you don't pay 30 days after the due date, your credit score will be affected for seven years. If you miss two payments, your score can drop up to 100 points.

- Make sure you're responsible with all of your finances. Unpaid bills, rent, and even late library books can negatively impact your credit score.

- Keep an eye on your credit score every so often. Everyone can get a free credit report once a year from the three major credit bureaus. Other websites offer free credit scores, but they aren't necessarily the FICO scores that lenders will see.

So there you have it. We have covered a lot of ground and in very broad strokes, and encourage you to read more deeply into the topics relevant to you before making life-changing decisions. Comment suggestion: share your own income stream ideas!

Just walk in there and give em a firm handshake. What's so difficult!

thanks for this because I really didn't know this shit, and probably would of learned it really late in life with a low credit score